By: Geeq on Nov 23, 2022

ESG is becoming a “must have” for organizations. But how can you prove that you really walk the walk? To take full advantage of your ESG investment, data management and consistency is key.

Not so long ago, an environmental and social governance (ESG) policy was considered to be a “nice-to-have” marker of corporate culture. By communicating that ESG was important to your business, you could win customer goodwill and boost employee morale. The specifics of ESG were fuzzy and ill-defined, however, and many regarded it purely as an expense, akin to philanthropy.

ESG — a regulatory imperative

In the past decade, the picture has rapidly changed. What was an optional side project has become both a regulatory necessity and a strategic opportunity for firms. In 2014, the EU passed a directive which requires companies to include standardized information about non-financial factors in their reports. The scope of the reporting requirements is continuously expanding, but existing and draft regulations cover factors such as environmental sustainability, employment conditions, observance of human rights, anti-corruption measures, and board diversity. In the US, the Securities & Exchange Commission (SEC) announced in March this year that it was introducing similar requirements for public companies in relation to standardized climate disclosures.

Beyond compliance: the benefits of ESG

However, ESG should not be viewed purely through the lens of compliance: it presents significant opportunities too. Building a trustworthy and demonstrable track record as a leader in the field of ESG can help a firm foster brand loyalty among existing clients and reach out to younger generations of millennial and GenZ consumers, for whom climate action is a particularly high priority. In terms of reputation management, by playing a leading role in adopting ESG measures, you can also raise the credibility, stature and influence of your firm among both media organizations and governmental bodies.

Adopting ESG measures often makes good business sense too. In endeavoring to reduce the extraction of raw materials and use fewer resources, for instance, you can decrease costs and increase efficiency. By creating a safe working environment for employees and paying fair wages, you can increase the satisfaction and productivity of your workforce. It can also have a direct effect on stock market performance due to the growing tendency for investors to take ESG factors into account when building their portfolios. Furthermore, all of the big three credit rating agencies — Moody’s, Standard & Poor’s, and Fitch — now incorporate ESG factors into their ratings.

The data challenges of ESG reporting

Collecting the relevant information for meaningful ESG reporting is a complex procedure, and standardizing it to allow proper analysis, with consistent, comparable data points, is even more challenging.

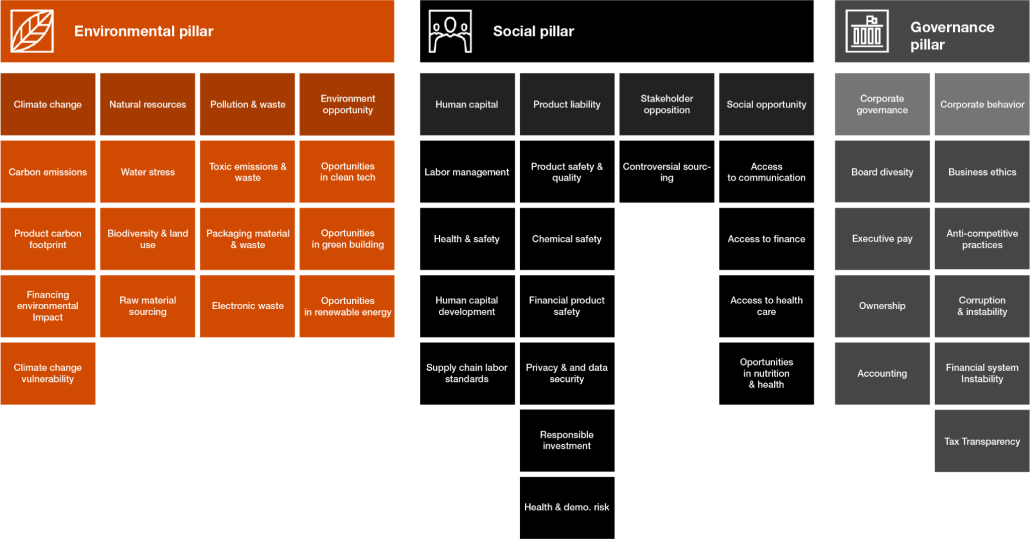

Take a clothing manufacturer, for example. A typical garment might contain cotton sourced in India, be manufactured in Bangladesh, and sold in the US. Relevant environmental criteria would include the sourcing of the cotton, carbon emissions during manufacturing, water usage, and the sustainability of packaging. Social criteria would encompass factors such as the safety measures at the factory and the pay and conditions offered to workers. Finally, governance indicators could involve metrics such as the diversity of the firm’s board, and the degree of transparency of its financial practices.

The indicators relevant to ESG assessment often require a wide array of data, some of which has not previously been actively managed. ESG performance covers a multitude of factors that are hard to measure, and which stem from multiple, largely unstructured sources across an organization (and even outside it). Supply chain data is a crucial input, but so are records from HR, investments, facilities management, and many others. The data may need to be collected from various sites, and from external suppliers as well as subsidiaries; it may even need to be reconstructed or sourced from independent data providers. In addition, it may come in formats that are hard to quantify, such as emails, photos, satellite imagery, customer feedback, and contracts.

This can add up to quite a messy picture. When implemented effectively, ESG reporting should help a firm to set measurable goals and track improvement. But poor data quality does not lend itself to robust reporting and ESG management. Furthermore, ambiguity or inconsistencies between data records could quickly lead to accusations of “greenwashing” in today’s consumer and media environment.

Towards ESG-friendly data management

As recently argued at COP26, data forms the basis of a strong ESG program. Consistent, clear, well-sourced data is a prerequisite for good ESG practice. With standardized, reliable, accessible data at your fingertips, you can make better decisions faster. And given that ESG relates to so many business areas, and is important to so many stakeholders, adopting ESG-friendly data practices will make for better management and a stronger market position.

To be prepared for regulation and make the most of ESG investment, organizations need to establish strong data management practices across the board. If ESG falls under the CFO’s remit, as is often the case, the finance department’s data lifecycle management processes and tools will be useful. But given the wide variability of data types and sources, it will not be easy to simply apply finance rules to these multifaceted and unstructured records. To create an efficient ESG data management solution, it is necessary to establish data reliability and consistency at source, and enable discoverability.

Geeq — a lightweight, modular approach to ESG data management

Geeq Data was developed to meet this need. It’s a lightweight, easy-to-use tool that provides a data consistency layer that may be accessed by connecting all organizational units, with strict permissioning if desired.

Geeq Data allows organizations to prove the consistency of their data through time. Best of all, it does not require integration with existing information systems and may be automated in order not to disturb workflows.

Data is formatted in messages, called transactions, and sent to a Geeq blockchain. Each record may be tagged with user-defined metadata (such as the data source and owner, or labels to connect data or data ownership to the relevant reporting area), while the record itself is hashed and written to the blockchain. A hash is a form of one-way compression – it can be used to confirm whether two separate records are identical, thus verifying data consistency.

With greater certainty as to the provenance and reliability of records, and easy discoverability, it becomes much easier to find, harmonize and structure information.

Once validated, unstructured data can now be fit into a relevant framework and fed into reports, whether manually or through the use of automated tools. The CFO office can organize ESG-relevant data and provide a real-time information base to support decision making and auditing. The immutability and security of the blockchain provides an added layer of trust for consumers, suppliers and regulatory bodies alike. Your organization will be better equipped to make meaningful improvements based on measurable goals, meet regulatory demands, and reap the branding, reputational, operational and financial benefits from your ESG investment.

All through one, simple modular solution. Learn more about Geeq Data today.

Geeq Data is the private blockchain solution for enterprise

Are you ready to learn more?

Go To Geeq Data

To learn more about Geeq, follow us and join the conversation.

@GeeqOfficial