By: Geeq on Mar 23, 2021

Dear Geeq Community,

In preparation for the opening of the staking pools we offer this GEEQ UNI-V2 Liquidity Staking Guide.

Happy Staking!

UPDATE:

If you participated in our previous round of Web Staking and you need to unstake your tokens, please go to the following links:

To unstake from the previous GEEQ STAKING ONE pool (now unlocked at full maturity): go here.

To unstake from the previous GEEQ STAKING TWO pool (now unlocked at full maturity): go here.

To unstake from the previous GEEQ LIQUIDITY pool (now unlocked at full maturity): go here.

Thank you for your continued support!

For step-by-step directions on how to unstake, please see our How To Unstake Guide.

🎉 ONTO the NEW Webstaking Geeq Liquidity Pool (open Saturday March 27)🎉

Stake UNI-V2 LP tokens and receive double benefits!

The terms of the Geeq Liquidity Staking pool (rewards, lengths, minimum contribution, etc.) are detailed below:

Geeq Liquidity Staking:

- Stake your Uniswap v2 LP tokens here

- Rewards: Uniswap Trading Fees + 85% APY

- Full maturity: 60 days

- Early withdrawal after: 30 days

- Early withdrawal: 30% annualized

- Pool Size: $200k GEEQ/ETH each side lockup

- Contribution window closes on April 3rd at 2 pm UTC (10 am ET) if pool is not filled before then.

Full terms and conditions are outlined here.

Requirements for Staking

Please note the following requirements:

GEEQ Liquidity Staking requires the ERC-20 wallet extension Metamask or a compatible Web 3 wallet which will automatically link to our staking contracts. This wallet will be used to contribute your token to the liquidity pool. It will also be used to distribute staking rewards upon withdrawal.

How to become a LP (Liquidity provider)

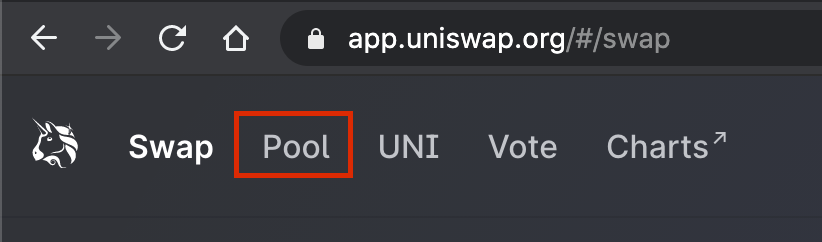

- Go to app.uniswap.org and click ‘Pool’ on the top left. (Direct Link: https://app.uniswap.org/#/add/ETH/0x6b9f031d718dded0d681c20cb754f97b3bb81b78)

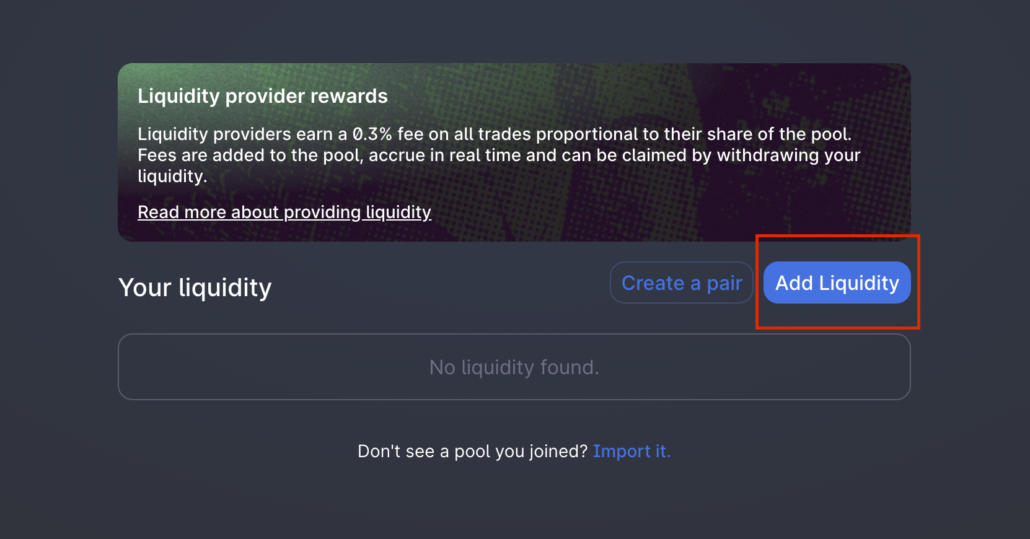

2. Click ‘Add Liquidity’ and enter GEEQ in the token search fields

GEEQ contract address (needed for the search tab)

0x6b9f031d718dded0d681c20cb754f97b3bb81b78

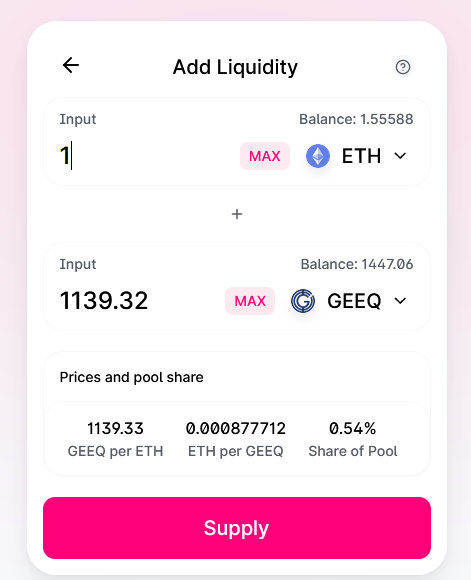

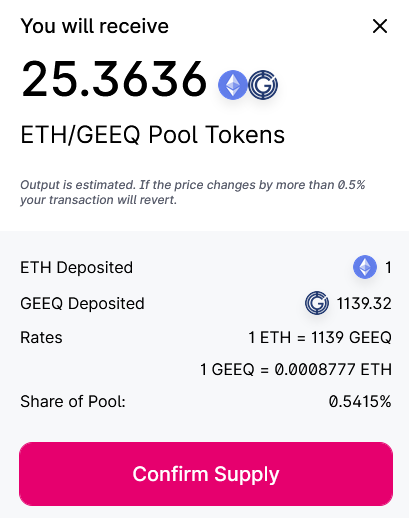

3. Click on Supply and confirm that you will receive ETH/GEEQ Pool Tokens and click Confirm Supply:

How to find UNI V2 tokens in your wallet

If you are going to be moving your LP tokens around, then here are some tips to help you so that you don’t freak out when you don’t see them in your wallet.

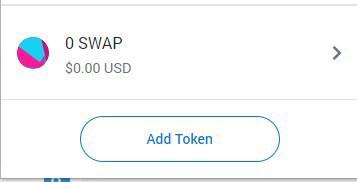

- Go back to your Metamask Click on Assets. Scroll down and click Add Token.

- Paste the following Token Contract Address:

0x2c814e0346672ce6813f7e1eaf944be8703ec10f

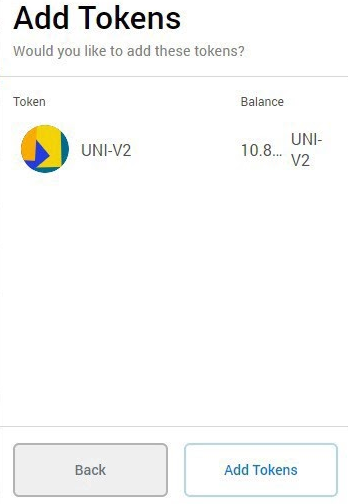

After entering the Token Contract Address, it will display UNI-V2. Please click next.

3. You will see this. Click Add Token. Now you will be able to see and manage your LP tokens in your Metamask wallet Remember they are ERC20 tokens, so you can transfer them to any Ethereum address.

You can now move your LP tokens from wallet to wallet.

Start Staking [GEEQ] Uni-V2 Pool Tokens

- Go to our staking website;

- Select the GEEQ staking pool and press “Stake” (when it opens);

- Authorize your MetaMask to be connected to the staking smart contract;

- After exploring the pool page and you are ready to stake, press “Stake”;

- Next, input the amount of UniV2 Tokens you wish to stake;

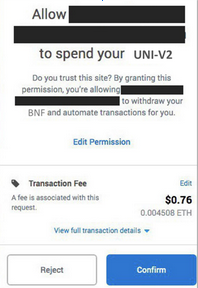

- MetaMask will pop up. Allow MetaMask to spend your Uni-V2 (i.e. send your Uni-V2 Tokens to the staking contract) and press “confirm”.

Please confirm whether the amount is correct and approve the allocation.

Please note that you will receive two requests to confirm on Metamask after you clicked on Stake.

IMPORTANT NOTE ON TRANSACTION FEES: you can edit the Ethereum Network gas fee in MetaMask by pressing “edit” and choosing a custom gas fee. Note that lower fees have slower transaction times.

CAUTION: DO NOT DIRECTLY SEND UNI-V2 TOKENS TO THE STAKING CONTRACT, ONLY USE THE PROVIDED USER INTERFACE!

ANY TOKEN SENT DIRECTLY MIGHT BE LOST

How to unstake

The option to unstake will open up in 30 days for the GEEQ liquidity staking pool.

General Overview of GEEQ Staking

To understand critical concepts such as staking pools and early withdrawals, please refer to our Staking Overview.

To learn more about Geeq, follow us and join the conversation.

@GeeqOfficial